A guide for partners and brokers

Working with us

A flexible loan facility for SME’s

Flexible Business Loan

What are our minimum requirements?

Flexible Small Business Loan Product

We require the below basic information in order to provide a conditional approval.

“Lite” Low Doc

$20K-$50K

Low Doc

$50K-$100K

Full Doc

$100K-$250K

Generous commissions for partners

Why Propell?

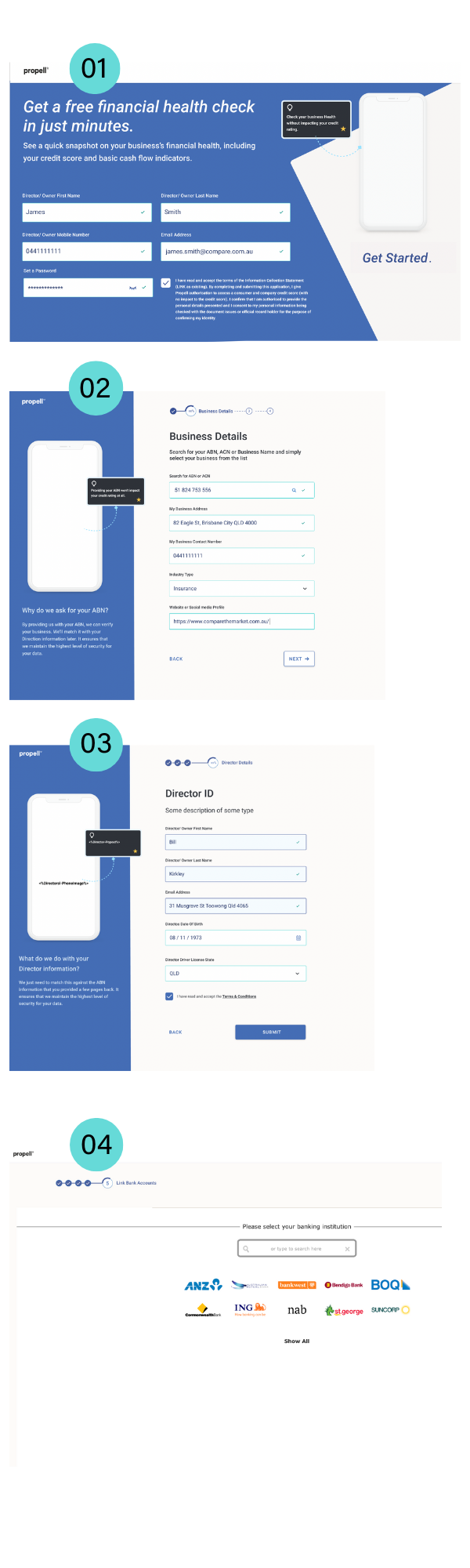

The process

1 – Submit a scenario

Submit your deal scenario to deals@propell.au, ensuring you include all relevant information. Complete documentation upfront means a smoother process.

You will receive a confirmation email confirming we’ve received your deal.

2 – We’ll provide an indicative outcome

Lite credit checks only will be completed at this stage.

3 – Collation of any additional information

We may need to clarify certain aspects of the information provide.

4 – You’ll receive a conditional approval

We’ll provide you with an offer of amount and rate to discuss with your client.

5 – Permission for final credit checks and KYC

We’ll perform all final checks and verify the client.

6 – Loan contract and funding

We fund the client and you will receive your commission that day too.

Partner Expressions of Interest

FAQ’s

Here are some answers to our most common questions from brokers and partners.