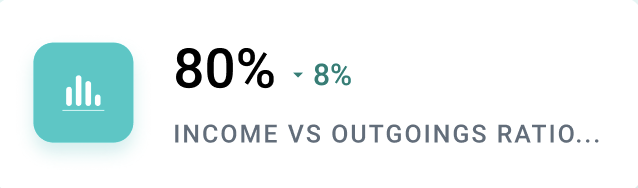

As an Australian financial services provider, we assess hundreds of businesses a week for our products. Using a few key cash flow indicators, we can determine if a business is in a good position to be able to afford to borrow funds from us. They are essentially how we determine if it’s a healthy business. Business Pulse opens the closet on the key factors that finance businesses review, because these are really important factors for you to understand the overall health of your business.

Business Pulse – Net working capital

What is it?

Essentially the portion (or percentage) of cash that you have left after your expenses have been taken care of.

Why it’s important

You need this to be a positive percentage, otherwise it means that you have more cash flowing OUT of the business than IN. If that is the case, you’ll need to take action to either increase your income, or reduce your expenses.

How it’s calculated

Net Working Capital = (Incomings – Outgoings) / Incomings

For example:

You’ve got $10K of incomings (cash flowing into the business)

and $9K of outgoings

= ($10K – $9K) / $10K = 0.1 = 10% left over

What’s considered good? And not so good?

| Good | Average | Poor |

|---|---|---|

| More than 10% | Between 0% – 10% | Less than 0% (negative %) |

How can I improve it?

- Look at some of your discretionary spending and review what can be cut

- Review what you might be able to transfer into revenue generating expenses, like perhaps a new employee that can help you output more work and increase income.

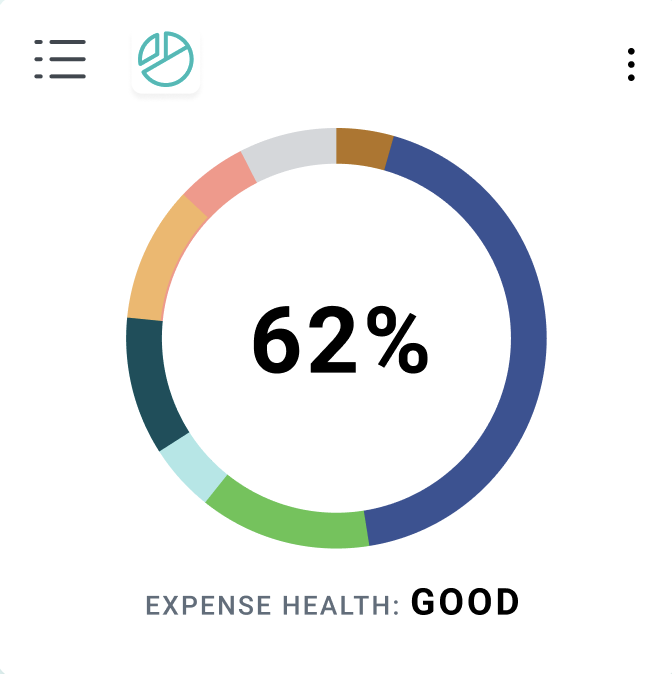

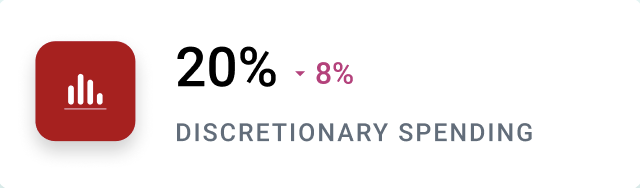

Expense Health and Discretionary Spending

What are they?

Expense health shows you the portion of expenses that your business incurs that generate revenue, versus those which don’t (known as discretionary expenses). The goal is to have a majority of your expenses as revenue generating.

Why are they important?

While you can run a profitable business with high discretionary spending, you can certainly help your cash flow by reducing it.

What type of expenses are considered revenue generating?

- Cost of materials and supplies

- Rent

- Salaries / wages

What type of expenses are considered discretionary?

- Lunches

- Subscriptions

- Gambling

How are they calculated?

We look at the total pool of your expenses and simply calculate what portion are revenue generating versus those which are discretionary.

For example:

$5K rent (revenue generating – good expenses)

$10K wages (revenue generating – good expenses)

$5K MCG Corporate Box (discretionary – “not so good” expenses)

Total expenses $20K, Total good expenses $15K, Total “not so good” expenses $5K

Good expense health = 15K / 20K = 75%

Discretionary spending = 5K / 20K = 25%

Whats considered good expense health? And not so good expense health?

| Excellent | Average | Poor |

|---|---|---|

| 100% good expenses | More than 95% good expenses | Less than 90% good expenses |

How can I improve it?

- Look at some of your discretionary spending and review what can be cut

- Review what you might be able to transfer into revenue generating expenses, like perhaps a new XX that you can use to grow income.

Items that affect lending (and say a lot about business health)

What are they?

These are items that we, as a finance provider, look at but they are in fact just general good health and hygiene aspects that every business should aim to adhere to.

What are some of the items?

They include activities like:

- Defaults on payments

- Late payments

- Court actions

- Using business funds for personal expenses or gambling

- Payday loans

Whats considered good? And not so good?

Honestly, it’s best to have none of these marked against your name.

| Excellent | Average | Poor |

|---|---|---|

| 0 | 1 | 2+ |

If you’ve got comments or questions about our Business Pulse, we’d love to hear them! Get in touch with us here.